How AI Can Boost Predictive Maintenance In Manufacturing

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

The EC Sales List needs to be submitted periodically to HMRC to report supplies of goods and services to VAT-registered customers in another EU country.

Microsoft Dynamics® 365 Business Central allows companies to generate and submit the EC Sales List electronically over the internet to HMRC. There are a number of pre-requisites that need to be in place to allow the generation & submission of data such as:

These points aren’t covered in this blog but related information can be found online. In addition the Triangulation functionality relies on a manual process of ticking the EU 3-Party Trade box on Sales Headers.

To set up the EC Sales List functionality the following steps should be followed:

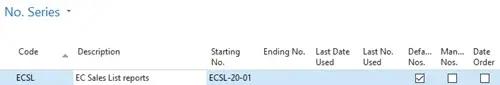

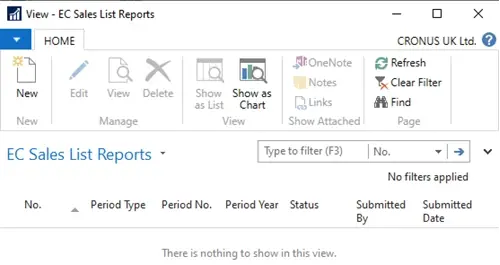

1. Set up a new number series for EC Sales List.

The No. Series Lines could be set up as new number for each year (see below) but this is only a suggestion.

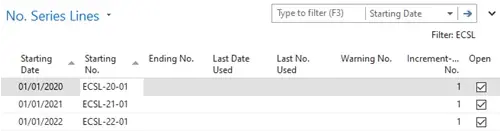

2. Search for the VAT Report Setup and in the No. Series field select the EC Sales List No. Series you have just set up.

3. Search for the VAT Reports Configuration page and create a new line with the following information:

VAT Report Type = EC Sales List

VAT Report Version = CURRENT

Suggest Lines Codeunit ID = 140

Submission Codeunit ID = 142

Validate Codeunit ID = 143

This completes the initial set up for the EC Sales List.

Next, we’ll have a look at using the functionality:

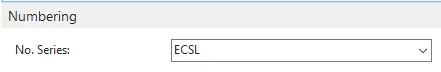

1. Search for and open the EC Sales List Reports, depending on the version you are in there may be a couple of similarly named pages. The page should look something like this...

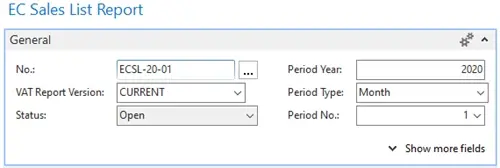

2. Click on the New action and move out of the No. field, this will fill in a number of fields in the header. Ensure the Period Year, Period Type and Period No. are correct for YOUR business. The General tab of the page should look something like the below:

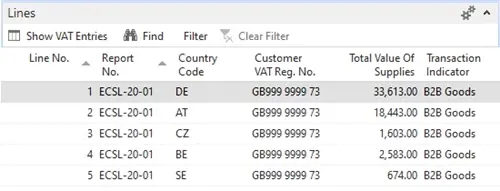

3. Click on the Suggest Lines action, this should then populate the report with transactions within the period specified. An example of what this will look like is below:

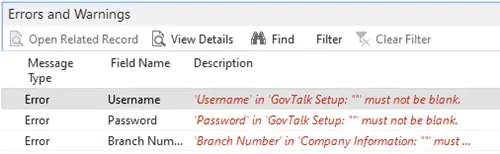

4. Once the lines have been suggested and you are happy with the detail in the report press the Release action. This will check a number of pieces of information required to submit the report and if there are any errors they will be shown in the Errors and Warnings tab. If you have already carried out the Gov Talk setup then the errors below should not occur:

5. After the report has been released you can then press the Submit action to send the detail to HMRC.

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

Summarising technology changes for manufacturing companies in 2023 and what that means for 2024 such as artificial intelligence and industry 4.0

Manufacturing, Warehousing and distribution company Colorlites implements Business Central ERP with Dynamics Consultants in a phased approach