How AI Can Boost Predictive Maintenance In Manufacturing

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

Cashflow is very often the thing that makes and breaks businesses, and as the help from the government through the lockdown will eventually end, businesses need to make sure that their cashflow is healthy whilst the economy takes time to recover.

Healthy cash flow is essential for the future of the Business. Here are some key tasks that you need to do to help you with making sure that your cash flow is healthy:

It is important to be aware that cash flow reflects the amount of money coming in or going out of a business; investments and daily financial activities must be balanced to keep the company afloat.

Cash shortages will hamper operations and hinder growth – it is important for owners not to make short-sighted decisions that can hurt the business in the long term.

Cash Flow Management is an essential and an integral part of business and financial activities and the need to maximize the use of software tools which give a broader, real-time assessment of a company’s financial situation, during the Covid 19 epidemic this is never more important.

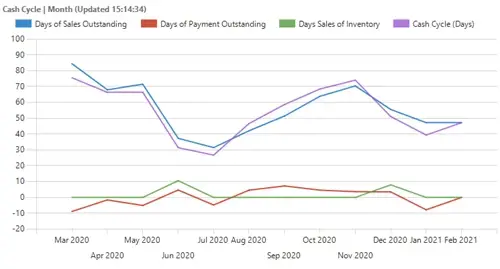

A company’s Cash Flow Statement often provides analysis and underlines an important gap between the revenue of sales from customers and payments out to suppliers.

A company’s Cash Flow Statement will also provide an insight into the need forecasting and can help to highlight the need for action, especially with the Government introduced schemes. This can be a key part of the decision to take part in the furlough scheme or talking to banks regarding lending.

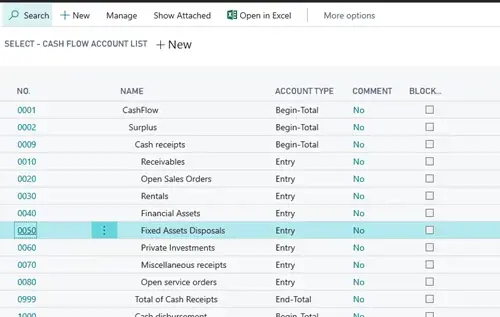

Microsoft Dynamics 365 Business Central (formerly NAV and Navision) has a range of cash flow tools to manage different cash flow sources:

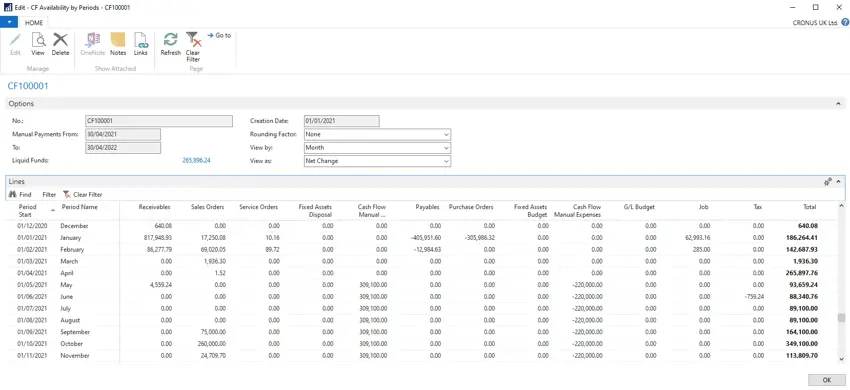

Cash Flow Forecasting is a calculation based on a number of intelligent assumptions and will enable the calculation of future cash flow. This, in turn, will give you confidence in the future of your business and enable you to make more informed decisions and create better planning for your company. The tools in Business Central are extremely flexible, allowing you to create multiple forecasts to allow for different scenarios.

Based on the information provided and your own personal set-up, you now have a powerful tool to enable precise and accurate forecasting. This will enable the generation of many different facets of accurate Cash Flow Forecasting, including manual revenues and forecast statistics, with fully detailed reports. Handy charts can be created and you are able to drill down into the data to look into the different areas of the business.

We have found that many businesses do not utilise the full capability of cash flow in Business Central or Dynamics NAV. Our expert consultants can provide in-depth 1-to-1 training via an online meeting to help you get set up and utilising the tools to make sure your business has a healthy cash flow in less than a day.

Contact us to discuss your requirements

This article is part of a series that we are calling "The New Business Normal", where we talk about everything that effects businesses following the outbreak of COVID-19.

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

Summarising technology changes for manufacturing companies in 2023 and what that means for 2024 such as artificial intelligence and industry 4.0

Manufacturing, Warehousing and distribution company Colorlites implements Business Central ERP with Dynamics Consultants in a phased approach