Business Central Setup FAQs

Issue:

User wants to add new accounting periods

How to fix it:

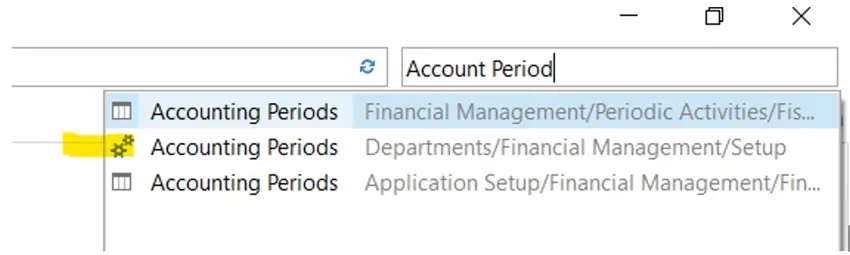

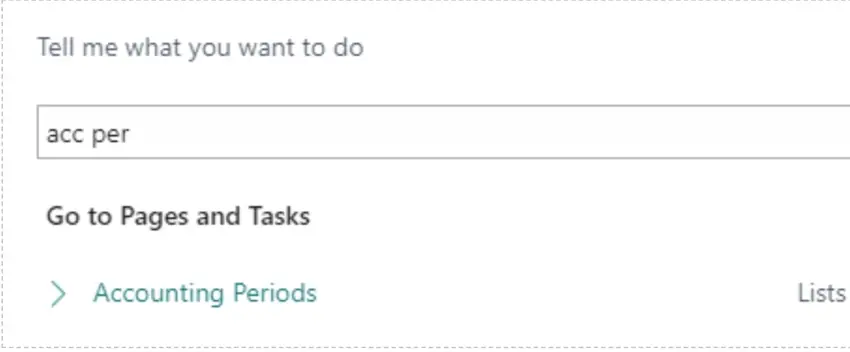

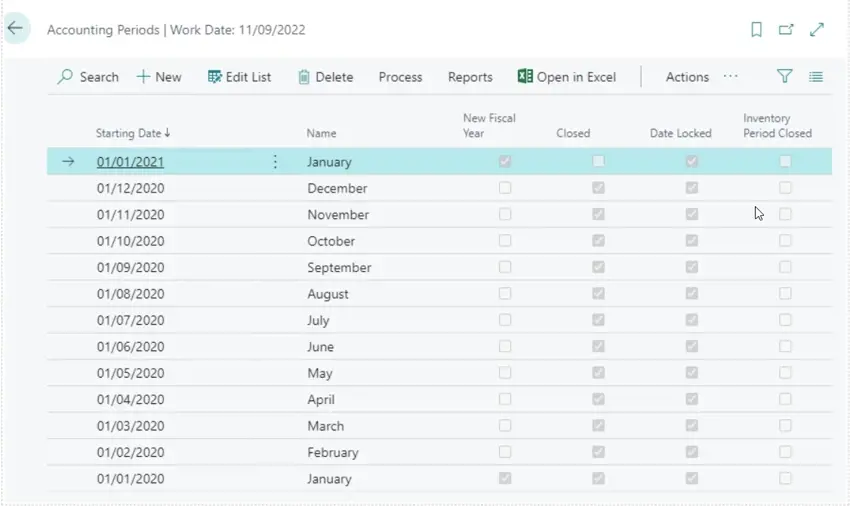

Navigate to Accounting Periods

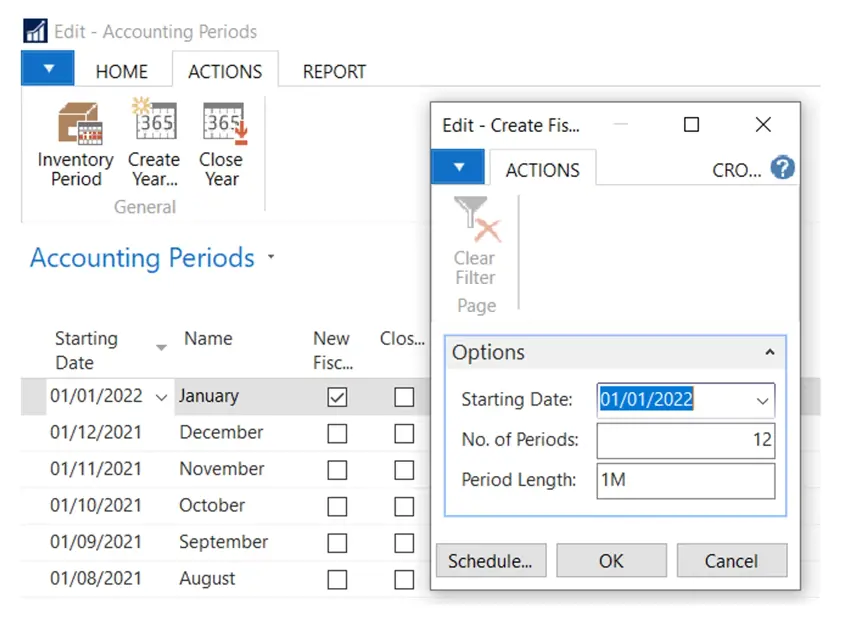

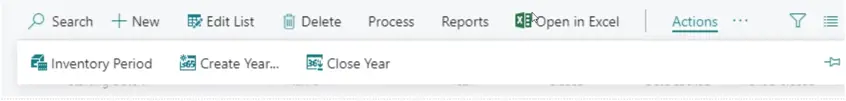

On the Home or Actions tab, Create Year

For custom Accounting Periods, the Starting Date can be edited.

Issue:

On the VAT returns page, Periods that have previously been submitted are still showing as open.

How to fix it:

When running the Get Periods function, expand out the dates to include the older periods. The function not only gets new periods as needed, this will also retrieve updates on previous ones and set to close where appropriate. However, one thing to note is that if it’s the first time including older periods, sometimes it errors because the date periods aren’t quite matching. To rectify, set the date range to only be the old periods (so it is not trying to get new ones too) and it will close these off.

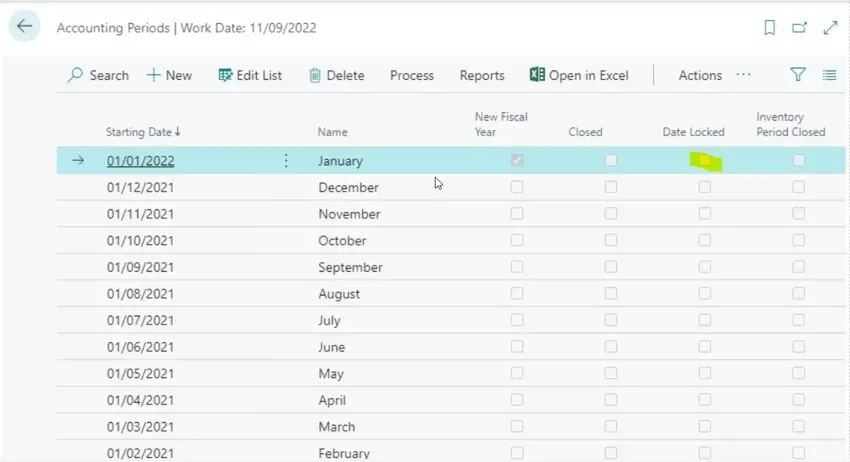

How do I extend my Accounting Period

When a year is closed, the dates in it are locked and cannot be changed, including the starting date for the new fiscal year.

(Note that closing a year is not a process that can be reversed by a user.)

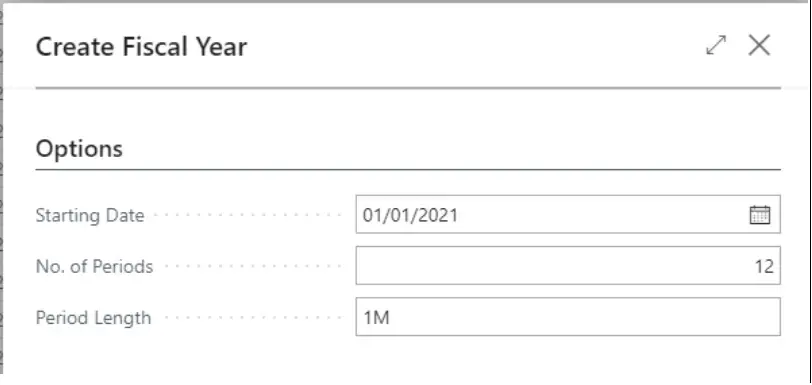

Create Fiscal year defaults to creating 12 monthly periods, but this could be changed to 18 if desired.

Note that the subsequent new fiscal year is not date locked, so the new fiscal year tick could be removed and additional months added manually.

Then a later new fiscal year start could be ticked. A new fiscal year can be in any month, it does not have to be 1st January.

Once the periods have been created, the start dates and descriptions can be edited – for instance to have 4/4/5 week periods.

Provided the dates have not been locked, accounting periods can be deleted or added at any time.

Business Central (Nav) will still operate without any periods, as it uses transaction dates rather than periods.

So period starts can be adjusted retrospectively part way through a year if required.

Which G/L accounts should have direct posting enabled?

Any account which is a control account for a subledger, such as Customers, Vendors, VAT, Bank, Stock should only allow system posting.

It is also useful to keep certain P&L accounts for system posting so that entries reconcile to Value Entries for instance.

In simple terms any accounts specified in the following areas should not be used for direct posting.

-

VAT Posting Setup

-

Bank Account Posting Group

-

Inventory Posting Setup

-

Vendor Posting Group

-

Customer Posting Group

-

General Posting Setup

-

FA Posting Group

It is possible to identify direct postings by filtering GL Entries using “system-created entry = no”.

Corrections can then be made if required to make sure that the control accounts represent the entries in the sub-ledgers.

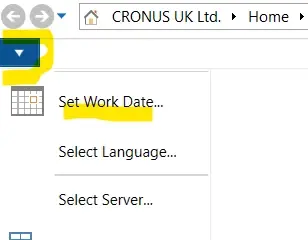

When trying to post a reversing journal, the user gets the error “Nothing to post”.

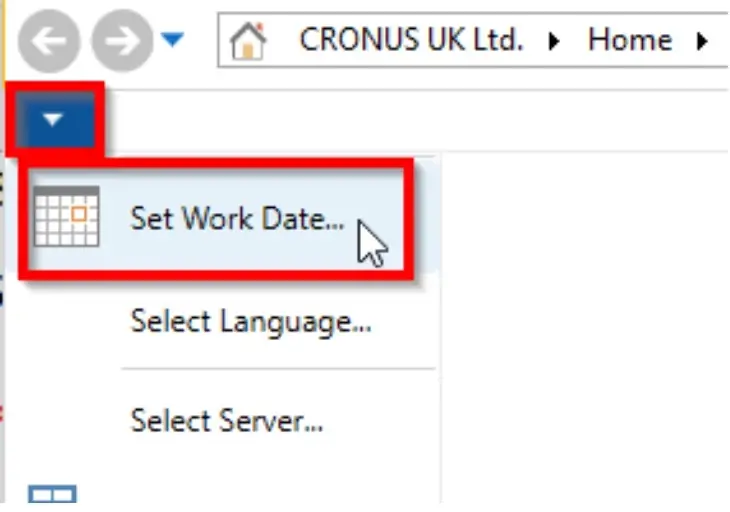

Reversing journals will only post when the Work Date or Actual date is the same or later than the journal posting date.

Change the workdate if required:

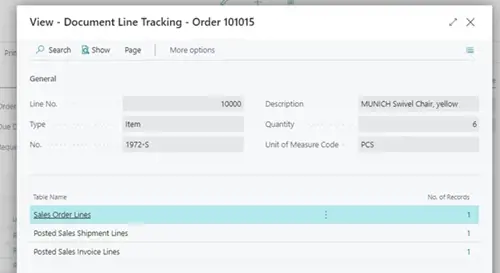

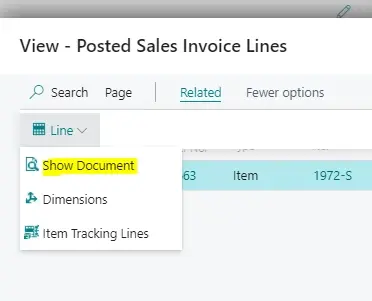

Issue: Finding Linked Documents

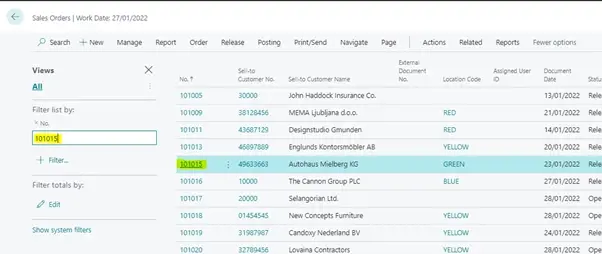

Method : Firstly navigate to your “Sales Order” or “Purchase Order” List as below..

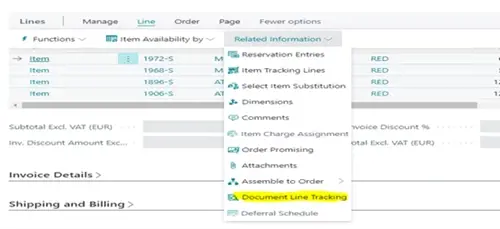

You can view documents that are related to sales order lines and purchase order lines, including from archived order lines. Related documents that you can track include quotes, shipments, receipts, and blanket orders. This helps you to identify documents used to process orders

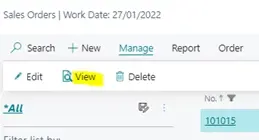

You can either use the filter function or highlight the Order on the list to find the applicable Order, then select the “Manage” tab, and then Select “View” as in examples below:

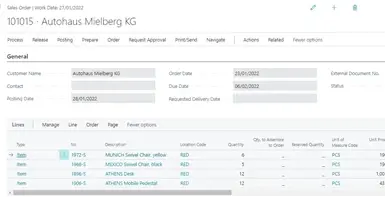

If you then select the below..

You will see this.. and from here you will be able to see the Related Sales Shipment Document or the Related Sales Invoice Document as below:

These functions are also applicable for Purchase Order documents too.

FAQ: "Nothing to post” Error on Reversing Journals

Issue: When trying to post a reversing journal, the user gets the error “Nothing to post”.

How to fix it: Reversing journals will only post when the Work Date or Actual date is the same or later than the journal posting date.

Change the workdate if required:

How do we get the VAT Registration Validation to check UK VAT numbers post Brexit?

Following Brexit on the 1st of January, the existing “EU VAT Registration No. Validation” function will no longer check UK VAT Reg. numbers.

Unfortunately there is not a fix for this. When this functionality was introduced the UK was in the EU, and therefore the numbers could also be checked. Now that the UK is no longer part of the EU, it’s not included in the EU Vat Registration No. Validation.

We’ve done some investigation, and there is not (at the time of writing this) any other API service which allows the lookup of both EU and UK VAT Registration Numbers. HMRC provides ones just for UK VAT numbers.

However if you did still need a service that checks the UK and EU VAT Numbers, we can add the HMRC API into your system, then depending on the Country/Region code of the customer or vendor controls which VAT Validation to run, the UK or the EU. Please contact your consultant if this is of interest to you.