What’s New in Business Central 2025 Release Wave 2

The Autumn brings the second major release of the year for Business Central, as part of the 2 wave annual update cycle. Here we look at the highlight features.

How does Business Central help with or manage VAT rate changes. Following the Summer Statement introducing a special VAT rate for the hospitality industry, and countries such as Germany reducing VAT rates, it is important to make sure that you are managing these rates on your systems. Business Central has comprehensive tools to make sure that you can manage this, but you must use it correctly.

With August here and the new VAT rates for specific markets being changed, it is an important time to address how companies using Business Central can manage this. There are two main ways:

Here we will look at the options, why you would choose them and how you would manage it.

If you are dealing solely in the industries effected, or you have a small number of transactions, the simplest way to manage the VAT rate changes is to change the rate on that in the VAT Posting Setup. This would avoid changing the VAT Posting Group on items and G/L codes.

It must be noted that care must be taken close to the change-over dates. All possible Sales and Purchase orders & invoices and G/L journals involving VAT should be posted by the cut-off, and any remaining orders refreshed to the new rates to avoid “Full VAT” credits or invoices to correct them. It would be worth creating an additional setup for “old standard” for any exceptions.

Note that any new combinations created in VAT Posting Setup should be reflected in new lines within the VAT Statement, and that Business Central does not allow the same VAT Identifier with a different VAT % in a single VAT Business Posting Group.

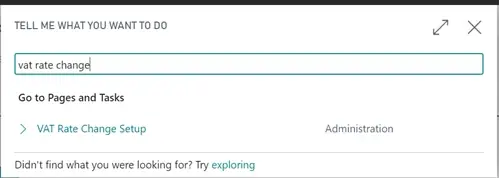

If you have a more complex requirement, such as a large number of open documents or you need separate G/L Accounts, a more complex requirements. For this, Microsoft have provided a comprehensive rate change tool which can be found by searching for “VAT rate Change Setup” in Business Central:

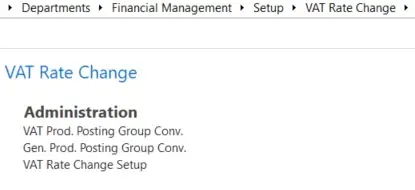

In Dynamics NAV, this can be found under Financial Management/Setup/Vat Rate Change:

For an in-depth guide to using the Vat Rate Change too, check out the guide from Microsoft.

If you need more help or want some training on VAT setup, our team of experts are here to help. We have a number of accountants on our team, and we have over 300 years of collective experience of Microsoft Dynamics NAV and Dynamics 365 Business Central.

The Autumn brings the second major release of the year for Business Central, as part of the 2 wave annual update cycle. Here we look at the highlight features.

After a recent visit to the Digital Manufacturing 2day event in Coventry and an insightful presentation by Lord Chris Holmes, I thought I would delve a bit deeper into the current AI regulation facing UK industry.

Choosing the right ERP system when moving on from Sage 50 can shape how efficiently your business grows and adapts. If you want advanced features, greater flexibility and easier integration with familiar Microsoft tools, Microsoft Dynamics 365 Business Central is often the stronger option compared to Sage 200. As real-time data insight, automation and scalability are now necessities and not luxuries, your ERP upgrade decision is more important than ever.