What’s New in Business Central 2025 Release Wave 2

The Autumn brings the second major release of the year for Business Central, as part of the 2 wave annual update cycle. Here we look at the highlight features.

The EC Sales List needs to be submitted periodically to HMRC to report supplies of goods and services to VAT-registered customers in another EU country.

Microsoft Dynamics® 365 Business Central allows companies to generate and submit the EC Sales List electronically over the internet to HMRC. There are a number of pre-requisites that need to be in place to allow the generation & submission of data such as:

These points aren’t covered in this blog but related information can be found online. In addition the Triangulation functionality relies on a manual process of ticking the EU 3-Party Trade box on Sales Headers.

To set up the EC Sales List functionality the following steps should be followed:

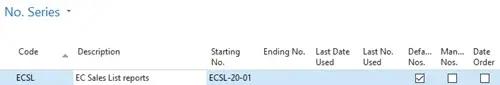

1. Set up a new number series for EC Sales List.

The No. Series Lines could be set up as new number for each year (see below) but this is only a suggestion.

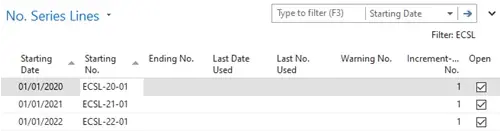

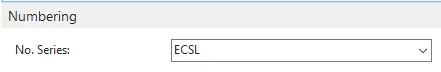

2. Search for the VAT Report Setup and in the No. Series field select the EC Sales List No. Series you have just set up.

3. Search for the VAT Reports Configuration page and create a new line with the following information:

VAT Report Type = EC Sales List

VAT Report Version = CURRENT

Suggest Lines Codeunit ID = 140

Submission Codeunit ID = 142

Validate Codeunit ID = 143

This completes the initial set up for the EC Sales List.

Next, we’ll have a look at using the functionality:

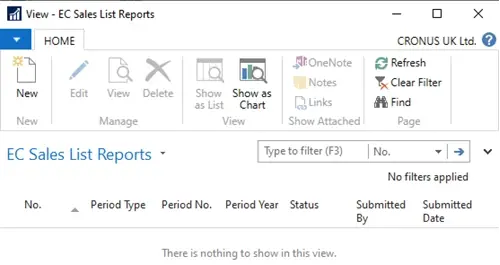

1. Search for and open the EC Sales List Reports, depending on the version you are in there may be a couple of similarly named pages. The page should look something like this...

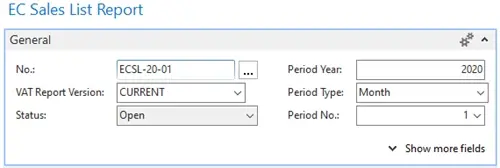

2. Click on the New action and move out of the No. field, this will fill in a number of fields in the header. Ensure the Period Year, Period Type and Period No. are correct for YOUR business. The General tab of the page should look something like the below:

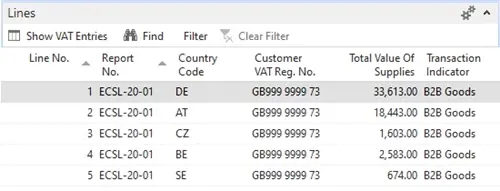

3. Click on the Suggest Lines action, this should then populate the report with transactions within the period specified. An example of what this will look like is below:

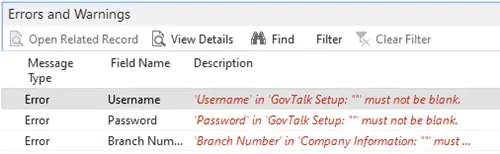

4. Once the lines have been suggested and you are happy with the detail in the report press the Release action. This will check a number of pieces of information required to submit the report and if there are any errors they will be shown in the Errors and Warnings tab. If you have already carried out the Gov Talk setup then the errors below should not occur:

5. After the report has been released you can then press the Submit action to send the detail to HMRC.

The Autumn brings the second major release of the year for Business Central, as part of the 2 wave annual update cycle. Here we look at the highlight features.

After a recent visit to the Digital Manufacturing 2day event in Coventry and an insightful presentation by Lord Chris Holmes, I thought I would delve a bit deeper into the current AI regulation facing UK industry.

Choosing the right ERP system when moving on from Sage 50 can shape how efficiently your business grows and adapts. If you want advanced features, greater flexibility and easier integration with familiar Microsoft tools, Microsoft Dynamics 365 Business Central is often the stronger option compared to Sage 200. As real-time data insight, automation and scalability are now necessities and not luxuries, your ERP upgrade decision is more important than ever.