What’s New in Business Central 2025 Release Wave 2

The Autumn brings the second major release of the year for Business Central, as part of the 2 wave annual update cycle. Here we look at the highlight features.

In this blog we will look at the Payment Registration function as an alternative to the Cash Receipts Journal for Sales/Customers and the administration functions that are used. As you are probably already aware there are numerous different ways in Dynamics 365 Business Central to fulfil the same task. The usual and most frequently used method of processing manual payments from Customers is to use a Cash Receipt Journal then we use the Apply Entries function to manually attach the payments. In this blog, we will look at the benefits of the relatively new Payment Registration tools, and how to set it up and use it.

You can use the Payment Registration process which will also result in an equivalent posted Cash Receipt Journal entry, but as you will see, this requires less effort for the user and less data entry.

And another advantage is the option to post your payments individually or as lump sum, making Bank Reconciliation against Statements so much easier.

There are 4 Main Steps to use the Payment Registration function as below:

So let’s look this in more detail and see how this can work for your Company and the benefits your Company can gain from using this functionality, along with how it aligns with the other Finance relationships Business Central has to offer.

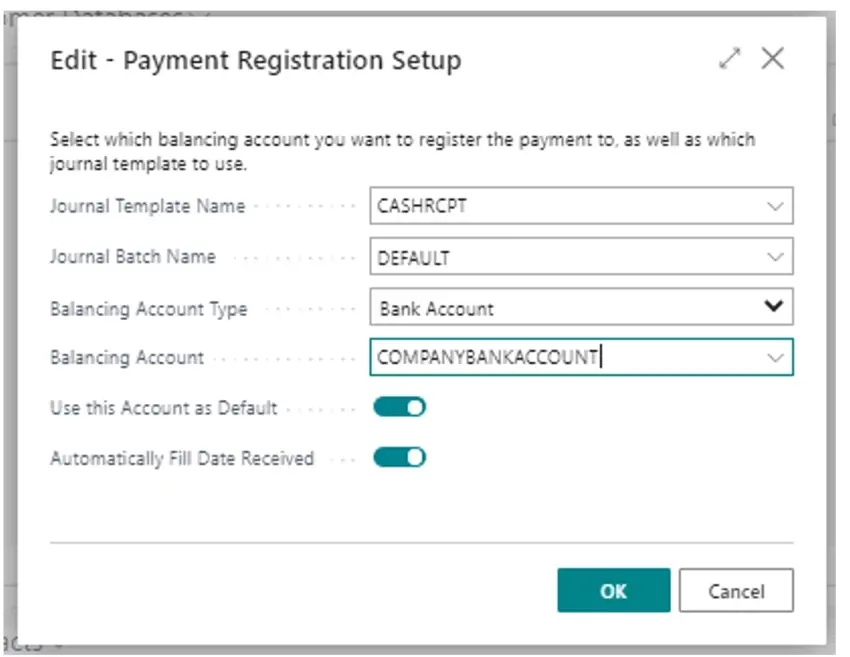

Fill this in as below:

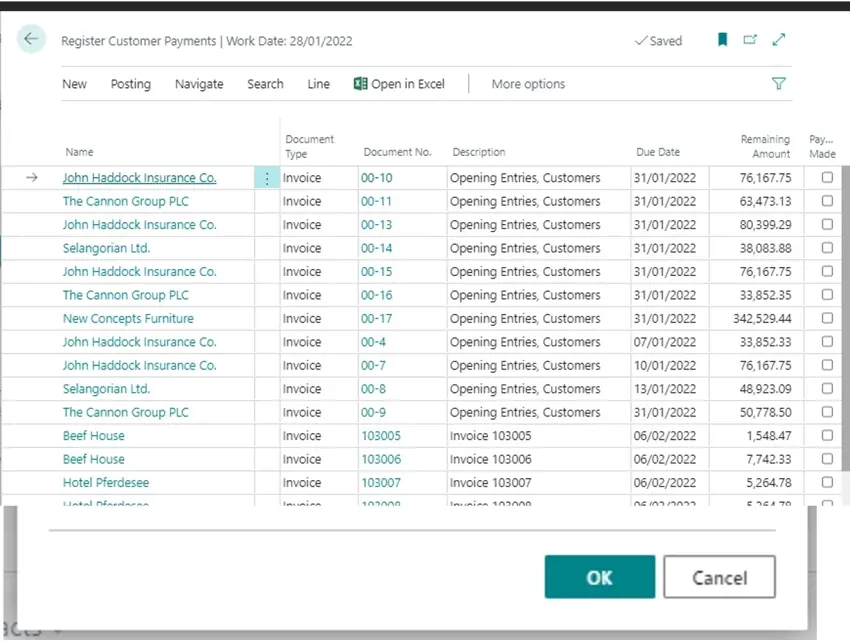

You can allocate your payments by using the tick boxes as below, so for a large Remittance Advice you can filter by Company and just tick the applicable transactions.

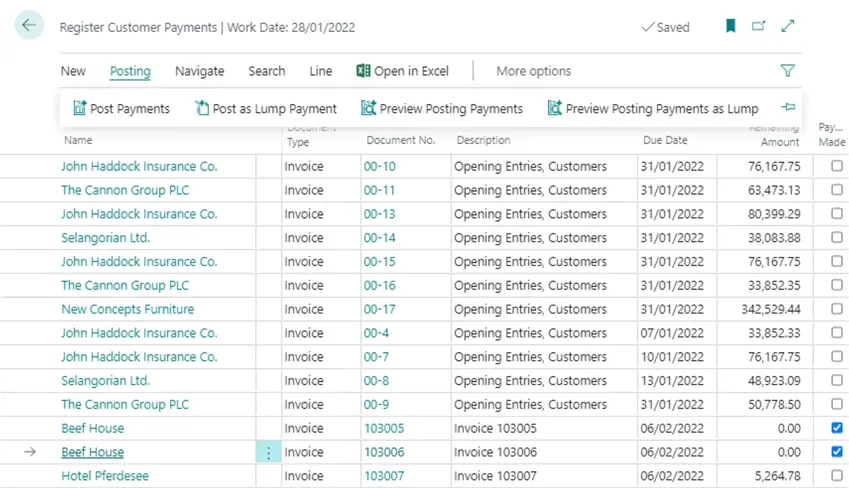

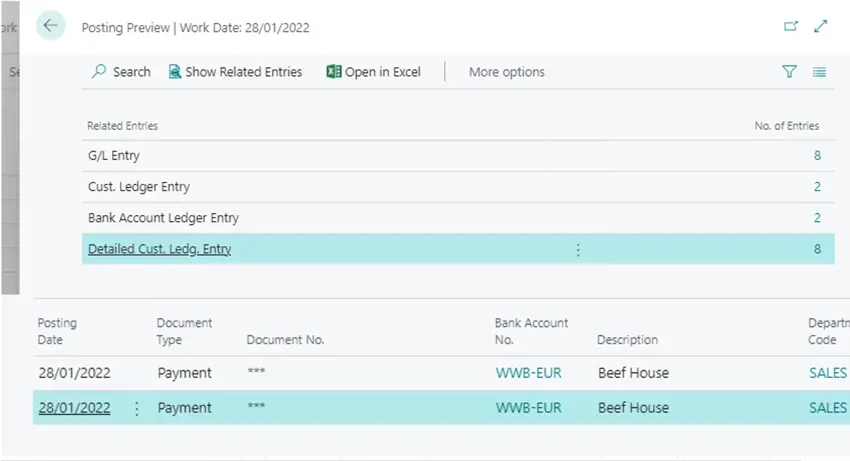

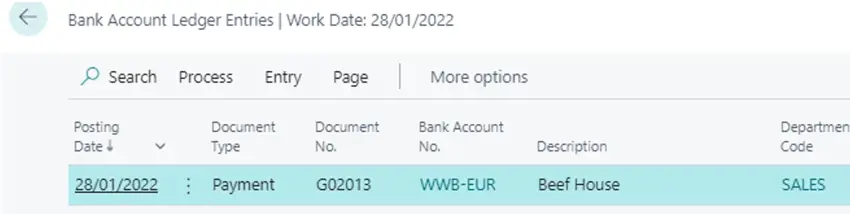

You can either do this as Lump Payment which will give you one Bank Ledger Entry or individually which will give you two Bank Ledger Entries ..

Here you can see the individual method with 2 Bank Ledger Entries for each line

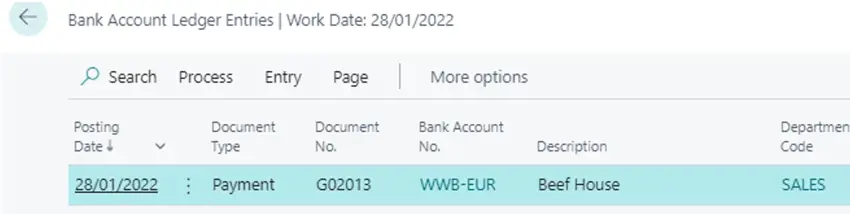

Or as a Lump Sum Payment with 1 Bank Ledger Entry, ,the benefits of using the Lump Sum method is it will make it far easier when you come to do your Bank Reconciliations.

Now we can see how this aligns in the system with the 4 Main Functions.

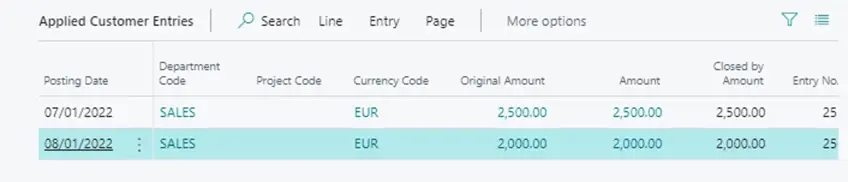

You can see that the entries have all been applied as Normal and your Customer Ledger has been updated to show the transactions as “Closed” as below..

You have an entry on your Bank Ledger either one line or multiple depending on your posting as below..

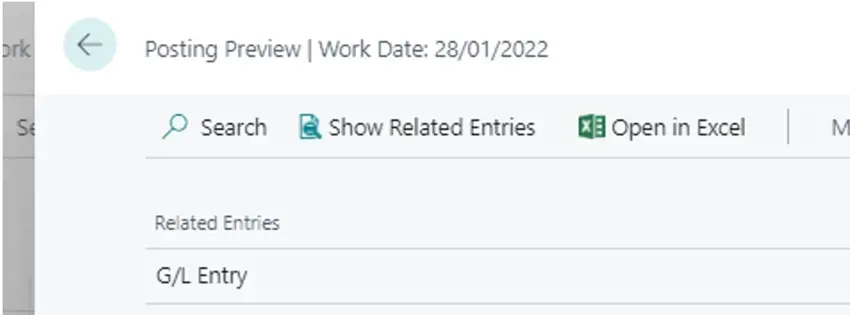

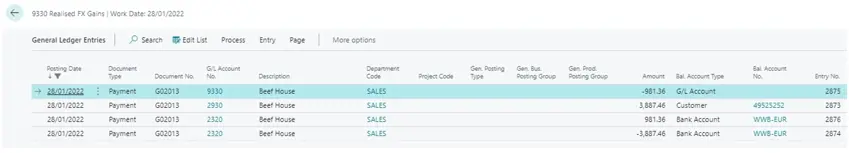

And as you can see all applicable General Ledger postings have been made just exactly the same as you would get with Cash Receipt Journal posting as below..

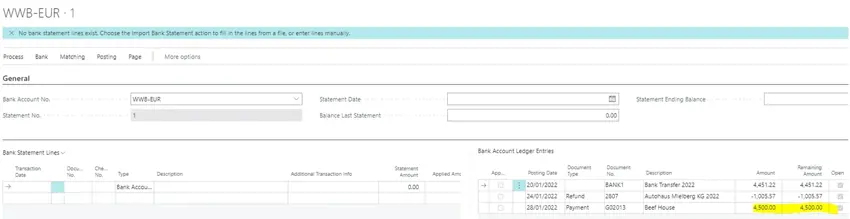

And then finally as you can see the Bank Reconciliation will pull in your “Open” Bank Ledger entries and make it far easier to reconcile your Statements, this is because mostly Remittance Advices will contain the full amount paid to your bank, so if you use the Remittance Advices when using the Payment Registration function, then this will align with what you have on your Bank Statements, making it much easier to use the “match automatically” function to clear as may entries as possible if not all of them.

So in summary the Payment Registration function will give greater benefits to your company and these are listed below:

The Autumn brings the second major release of the year for Business Central, as part of the 2 wave annual update cycle. Here we look at the highlight features.

After a recent visit to the Digital Manufacturing 2day event in Coventry and an insightful presentation by Lord Chris Holmes, I thought I would delve a bit deeper into the current AI regulation facing UK industry.

Choosing the right ERP system when moving on from Sage 50 can shape how efficiently your business grows and adapts. If you want advanced features, greater flexibility and easier integration with familiar Microsoft tools, Microsoft Dynamics 365 Business Central is often the stronger option compared to Sage 200. As real-time data insight, automation and scalability are now necessities and not luxuries, your ERP upgrade decision is more important than ever.