What’s New in Business Central 2025 Release Wave 2

The Autumn brings the second major release of the year for Business Central, as part of the 2 wave annual update cycle. Here we look at the highlight features.

It has been around 18 months since the government requirement for submitting tax returns turned digital – Making Tax Digital. The authorisation code (the HMRC access token) that allows your software to create a connection with HMRC is only valid for 18 months and so, for the first time, companies will be starting to get errors when trying to file their tax returns! In this article, we will look at why we are getting this issue, and for those using Dynamics® NAV or Business Central, how to fix the error “OAuth setup is not enabled for HMRC Making Tax Digital. Open service connections to setup.”

The authorisation granted by HMRC for third party tools to submit VAT returns is done via an authorisation token. Tokens are normally provided with a time limit for a wide range of reasons, including security – the Making Tax Digital (MTD) authorisation token is set to expire after 18 months. This means that you will need to request a new token every 18 months. Don’t worry, it is a relatively simple process, and of course it is free to do.

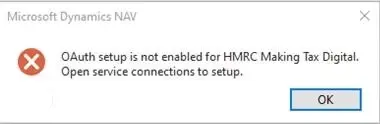

If you are a Microsoft Dynamics NAV or Dynamics 365 Business Central user, the most likely way that you will find out that your token is out of date is because you will get the following warning whilst trying to submit your VAT return:

“OAuth setup is not enabled for HMRC Making Tax Digital. Open service connections to setup.”

This warning is an indicator that your 18month HMRC access token has expired. We will now look at how to rectify this.

It is likely that your Microsoft Dynamics system is already set up for connection with HMRC, however as part of the process to request a new authorisation code is to go via the setup, we will provide all of the details so that you can check that your system is setup correctly.

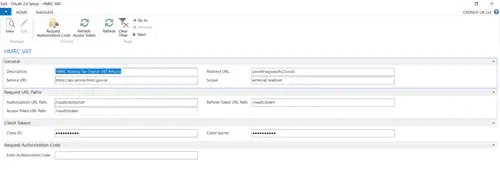

In NAV or Business Central, open the Service Connections page. Highlight the HMRC VAT Setup line and click on the Setup button at the top of the page. The following screen will appear, and you need to fill in the fields as follows:

Your page should look like the screenshot below:

The Client ID and Client Secret fields are available from your partner.

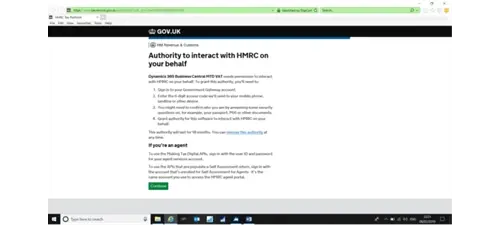

To complete the setup, click on the Request Authorisation Code button. You will see a prompt asking you if you want to encrypt the service data like the screenshot below:

Click on Yes.

The following screen will then appear:

Enabling encryption will mean that various pieces of MTD information will be held in the database in an encrypted format. This is optional. You can either import an encryption key to use or have NAV/Business Central generate one for you. To use this facility, click on either Enable Encryption or Import Encryption Key. If you don’t want to use encryption, simply Close the screen to continue. You should then see the following screen:

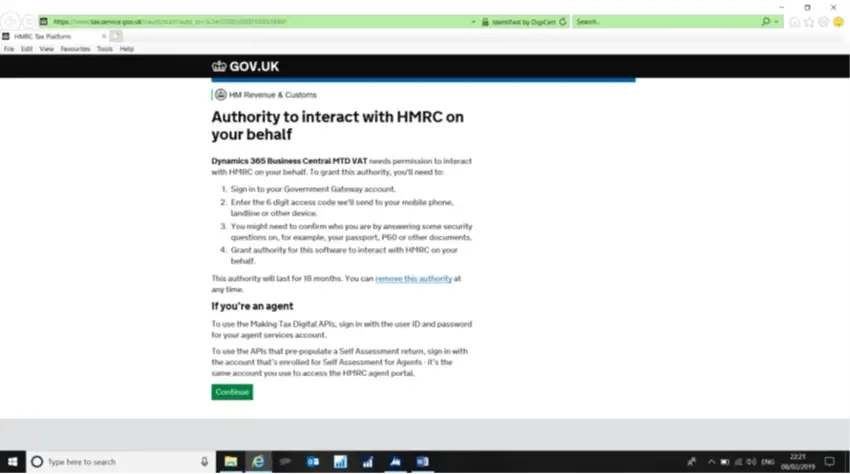

When you click on the Continue button, you will be prompted to log on to the Government Gateway using your Government Gateway ID and password.

Enter your username and password and click on the Grant Authority option. The site should return an Authorisation Code. Click on Copy and paste it into the Enter Authorisation Code box on the OAuth setup page in NAV/Business Central. The software will validate it and complete the setup process for MTD. It will take up to 2 working days for the HMRC to register your details on their servers.

If the authorisation is successful, a confirmation page prompts you to verify your VAT registration number. To open the Company Information page and verify the number is correct, and the one you have used to register with HMRC, choose Yes.

Because MTD is new, and there are a lot of changes, we are finding that companies are finding a wide variety of errors due to changes with HMRC or unexpected outcomes with the various technologies, such as this token issue or the TLS error from a previous article. We would recommend that you try to submit your VAT returns as soon as possible so that any issues that are encountered with the connection to HMRC do not make the submission of your VAT return late.

Our UK support team has been helping businesses with their Making Tax Digital requirements in Microsoft Dynamics NAV and Dynamics 365 Business Central. If you need help with support for your Dynamics Software, please do not hesitate to contact us.

The Autumn brings the second major release of the year for Business Central, as part of the 2 wave annual update cycle. Here we look at the highlight features.

After a recent visit to the Digital Manufacturing 2day event in Coventry and an insightful presentation by Lord Chris Holmes, I thought I would delve a bit deeper into the current AI regulation facing UK industry.

Choosing the right ERP system when moving on from Sage 50 can shape how efficiently your business grows and adapts. If you want advanced features, greater flexibility and easier integration with familiar Microsoft tools, Microsoft Dynamics 365 Business Central is often the stronger option compared to Sage 200. As real-time data insight, automation and scalability are now necessities and not luxuries, your ERP upgrade decision is more important than ever.