What’s New in Business Central 2025 Release Wave 2

The Autumn brings the second major release of the year for Business Central, as part of the 2 wave annual update cycle. Here we look at the highlight features.

UK VAT legislation on prompt payment discounts (PPD) will be aligned with EU VAT legislation.

The government has made changes to the way VAT registered persons and companies account for VAT where they offer or take payment discounts (PPD). The current process will be amended to align with the Principal VAT Directive (PVD) which requires VAT to be accounted for on the consideration actually received and was introduced in the Finance Bill 2014. Further information is available from the HMRC Website.

This blog explains the change and how to treat it using Microsoft Dynamics NAV® 2013 and all earlier versions of Dynamics NAV.

Currently, you only need to account for VAT on the amount of your sales net of payment discount.

For example:

Sales Amount net of VAT: £100.00

10% prompt payment discount (PPD): -£10.00

Net amount: £90.00

The VAT due will be £18, i.e. 20% of £90, rather than £20 which would be 20% of £100. Even if the customer does not take the discount offered, the VAT liability will still be £18.

With effect from 1st April 2015, the VAT due will vary depending on whether the payment discount is actually taken, so in the example above, if the payment discount is taken, the VAT liability remains £18. However, if it is not taken, then the VAT due increases to £20!

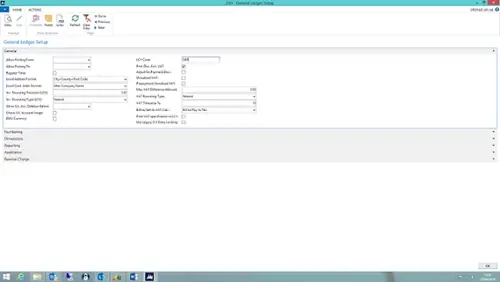

This change is easily handled in Microsoft Dynamics NAV from the General Ledger and VAT Posting Setup pages. If the company currently accounts for VAT net of payment discount, the General Ledger Setup page will look something like this:

As displayed, the Payment Discount Excluding VAT check-box is ticked and the VAT Tolerance % is set to 10%. This is the maximum percent that VAT will be adjusted to allow for payment discounts. If the payment discount on a particular transaction is more than this percentage, up to 10% only will be discounted.

To adjust the VAT treatment to take account of the new HMRC requirements, you will need to take the following two steps:

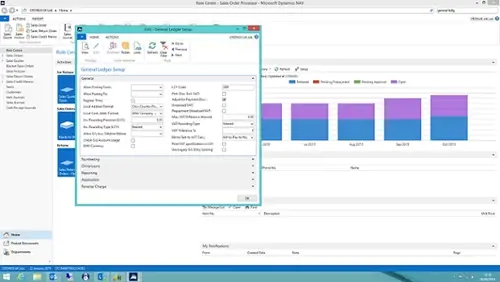

First, reset the General Ledger Setup page so it resembles the example below:

The Payment Disc. Excl. VAT check-box has been un-ticked and the Adjust for Payment Disc. check-box ticked. The VAT Tolerance % box is unchanged.

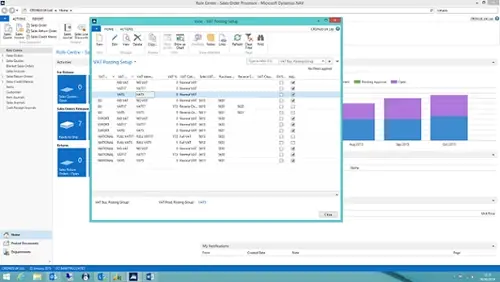

Next, reset the VAT Posting Setup entries as in the example below:

The Adjust for Payment Discount check-box has been ticked for all records except those where the VAT Calculation Type is Reverse Charge VAT. This is because these entries are both paid to and reclaimed from HMRC, so there is little point in adjusting them. The Full VAT Calculation Types are also not relevant for payment discounts.

Transitional Arrangements

This change takes effect from 1st April 2015 and applies to all invoices with a tax point on or after the date. Dynamics NAV will apply the change automatically once the changes to the setup described above have been made. If any invoices are added from 1st April and backdated, any changes needed to the VAT will have to be made manually.

If you liked this blog article, check out other blog articles from Martin!

Click the links below and don't forget to leave a comment.

Analysis Views in Microsoft Dynamics NAV 2013

Style Sheets in Microsoft Dynamics NAV 2013

Inventory Costing in Microsoft Dynamics NAV 2013

The Autumn brings the second major release of the year for Business Central, as part of the 2 wave annual update cycle. Here we look at the highlight features.

After a recent visit to the Digital Manufacturing 2day event in Coventry and an insightful presentation by Lord Chris Holmes, I thought I would delve a bit deeper into the current AI regulation facing UK industry.

Choosing the right ERP system when moving on from Sage 50 can shape how efficiently your business grows and adapts. If you want advanced features, greater flexibility and easier integration with familiar Microsoft tools, Microsoft Dynamics 365 Business Central is often the stronger option compared to Sage 200. As real-time data insight, automation and scalability are now necessities and not luxuries, your ERP upgrade decision is more important than ever.