How AI Can Boost Predictive Maintenance In Manufacturing

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

Microsoft Dynamics® NAV has a Fixed Assets module which allows you to record the costs and depreciation of Fixed Assets. This has comprehensive functionality but it works on a number of assumptions which may not always produce the results you would like. This blogs looks at two particular problems and how you can easily work your way round them.

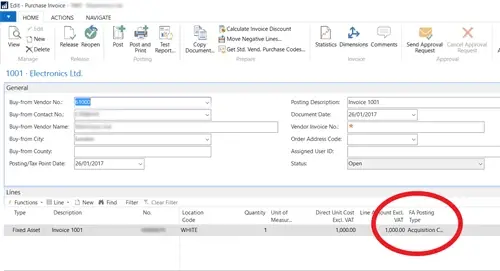

This couldn’t be simpler in Dynamics NAV. You just need to raise a Purchase Invoice and add the Fixed Asset as a No. on a Purchase Line. You can see in the image that the system has filled in the correct Fixed Asset Posting Type of Acquisition Cost by default.

When you post the invoice, its value will be added to the Acquisition Cost of the asset. The problem is that the life of the asset will be reset to start on the Posting Date of the invoice which means that the asset will not be depreciated between when depreciation was last calculated for it and the invoice posting date which may not be what was intended.

The Fixed Asset is purchased on 01/01/2015 at a cost of £1,000. It has an expected life of five years. It has been depreciated to the end of 2015?? so the depreciation to date is £200. (Straight line depreciation)

You then add a further £500 to the fixed asset value on 31/03/2016 and calculate the depreciation as at that date. This should work out at £175 (£50 depreciation for the original cost value and £125 for the additional cost). But because the additional purchase was made on or after the new depreciation date, no depreciation will be calculated for this which may be incorrect.

To get round this, there are two fields on the invoice line in Dynamics NAV that you need to tick as in the screenshot.

The Depreciate Acquisition Cost field which will depreciate the additional acquisition cost you post on the invoice. The Depreciate until FA Posting Date tick box will depreciate the new value of the asset from when it was last depreciated to the posting date of the invoice. This does mean though that the next time depreciation is calculated for the fixed asset, it will only be depreciated from the Posting Date of the invoice to the next depreciation date e.g. the end of the month.

You may sometimes want to change the life of a fixed asset, for example if it has been used less than was expected so it is still in use when it was originally expected to have to be disposed. In these cases, you may want the program to adjust the depreciation to date to reflect the new asset life.

A fixed asset is acquired on 01/01/2015 for £1,000. It had a five-year life so the depreciation to 31/12/2015 would be £200.

The asset life has now been extended to eight years so the depreciation to date should be £125 and £125 per year for the remaining seven years. The program will not make this adjustment automatically, instead it will depreciate the remaining Net Book Value of the fixed asset (£800) over the remaining life of the asset (seven years) at £114 or so per year.

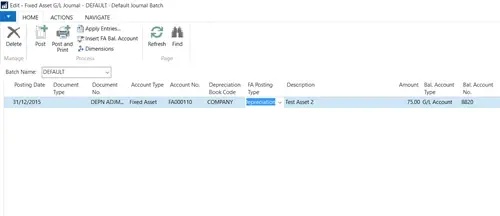

There is a straightforward way to get round this which involves posting the extra depreciation back into the previous period. To do this, open the Fixed Asset G/L Journal page as per the screenshot.

You then fill in the fields as follows:

Once this journal has posted, the depreciation going forward will calculate correctly.

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

Summarising technology changes for manufacturing companies in 2023 and what that means for 2024 such as artificial intelligence and industry 4.0

Manufacturing, Warehousing and distribution company Colorlites implements Business Central ERP with Dynamics Consultants in a phased approach