How AI Can Boost Predictive Maintenance In Manufacturing

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

The Jobs functionality in Microsoft Dynamics NAV® has been around for many years and from the start it has had the ability to calculate and post Work in Progress (WIP). This blog looks at what WIP is and how you can reconcile it within NAV. It assumes you have a basic knowledge of Dynamics NAV and the Jobs functionality within it.

Before going into detail about it, what is WIP anyway? One of the purposes of Jobs in NAV is to record the costs and revenues of a job and post them to defined G/L accounts. These are the sort of accounting transactions you might see in the course of a job:-

Debit – Staff Salaries £100, Credit - Bank Account £100;

Debit - Trade Debtors £200, Credit – Sales £200.

So these costs and revenues are “lost” in the normal company transactions.

When the job is complete, the costs and revenues are moved to a separate area of the accounts, a process known as job recognition. This would produce the following postings:-

Credit – Staff Salaries £100, Debit – Job Costs £100;

Credit – Job Sales £200, Debit – Sales £200.

(This assumes that the Applied Job Cost and Sales accounts are the same as the Sales and Staff Salaries accounts but they do not have to be.)

However, while a job has started but not finished i.e. it is in progress, it may be necessary to adjust the costs and/or revenues to reflect the progress on the job and the revenues and costs posted against it so far. If you do not do that, your nominal ledger (and that means the bottom line of the profit and loss you record) may not reflect committed costs or revenue when it should. This is why WIP calculations for jobs in progress may be needed.

This could give rise to the following kinds of General Ledger postings:-

Debit - Staff Salaries £100, Credit - Bank Account £100;

Debit - Job WIP £100, Credit - Job Sales Applied £100.

(In this case, the job has been half completed but none of it has been invoiced.)

All jobs must have a WIP Method assigned to them but if you don’t want any WIP to be calculated, it’s easy enough to make the postings general ledger “neutral”. To assign a WIP Method to a job simply enter it on the Job card as in the screenshot below:-

The choice made here interacts with the Job Posting Group (shown in the field above) as the G/L accounts WIP is posted to are set in the Job Posting Group for the job.

There are a number of different WIP Methods provided as standard and you can also create customised WIP methods. They basically divide into two types - where costs and revenues are recognised when the job is complete with everything being posted to WIP until then and where either costs or revenues are recognised as the job progresses and the either the costs or revenues are adjusted depending on the progress of the job.

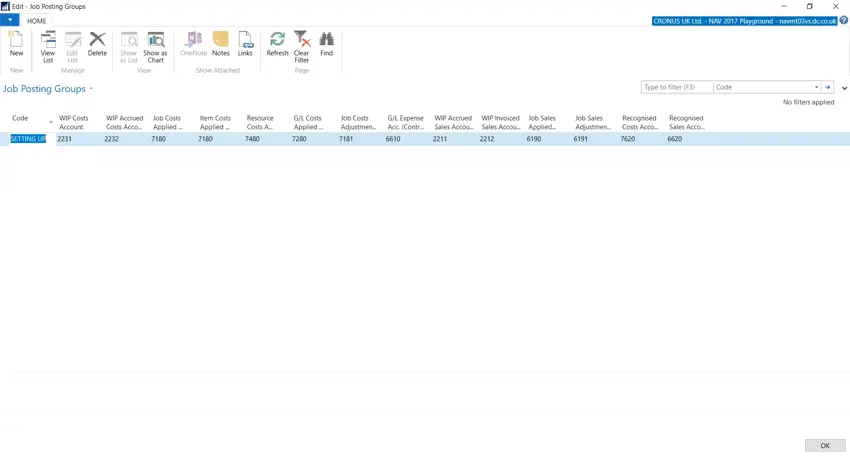

The G/L accounts used by the WIP Posting process are shown in the screenshot below:-

Different accounts will be used depending on the the WIP Method set for the job. As their name suggests, the Recognised Costs and Sales accounts will be used for costs and sales once they have been recognised which is the final step in the job costing process. These accounts should always be Income Statement accounts. The WIP account is used to record any WIP while the job is in progress with the balancing account being one of the various Applied accounts. The WIP accounts should always be Balance Sheet accounts.

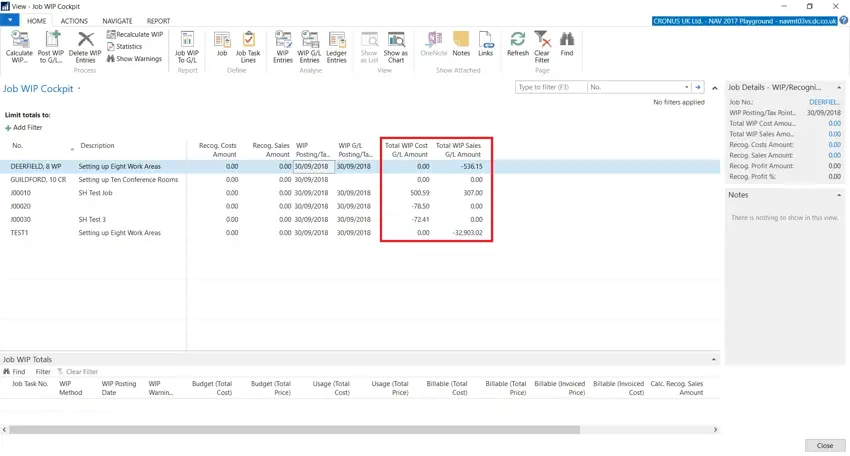

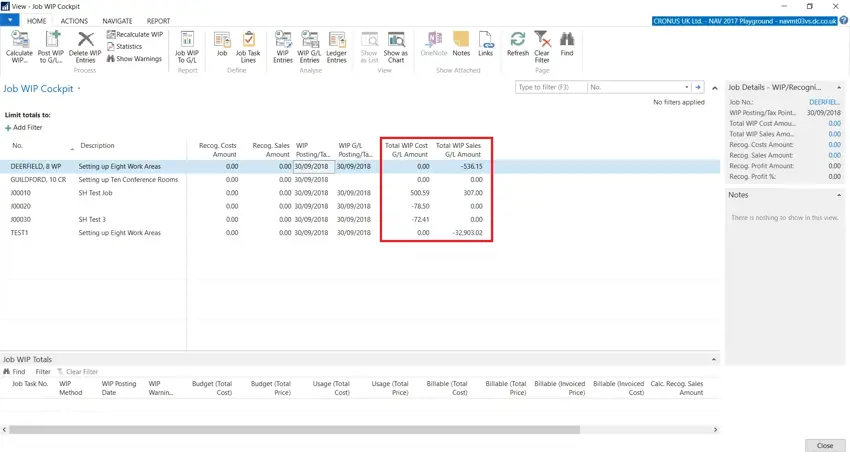

Once you have run the Calculate and Post WIP to G/L batch jobs you may need to reconcile the balances on your WIP G/L accounts with the balances held by job. The easiest way to do this is by running the the Job WIP Cockpit page. This should give you a screen like the one below:-

The highlighted totals should reconcile to the corresponding G/L account balances.

How can Artificial Intelligence be used for predictive maintenance in manufacturing? New software technologies are helping business operations.

Summarising technology changes for manufacturing companies in 2023 and what that means for 2024 such as artificial intelligence and industry 4.0

Manufacturing, Warehousing and distribution company Colorlites implements Business Central ERP with Dynamics Consultants in a phased approach